Healthcare Workforce Management System Market by Component (Software: Scheduling, Talent Management, Analytics, Service: Optimization, Consulting, Support), Type (Standalone, Integrated), End User (Hospital, Nursing Home) - Global Forecast to 2029

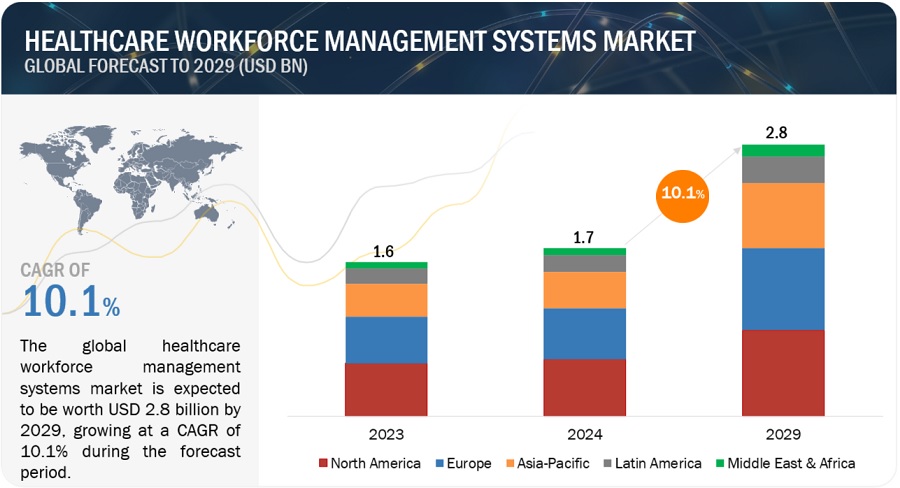

The global healthcare workforce management systems market in terms of revenue was estimated to be worth $1.7 billion in 2024 and is poised to reach $2.8 billion by 2029, growing at a CAGR of 10.1% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Factors such as growing demand for workforce optimization and mobile applications, rising adoption for cloud-based healthcare workforce management solutions, and increasing need to restrict healthcare costs through effective management of healthcare are driving the market. However, higher costs of deployment limit greater adoption of workforce management systems may restrain the growth of this market to a certain extent.

Global Healthcare Workforce Management Systems Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global Healthcare Workforce Management Systems Industry Dynamics

DRIVER: Increasing adoption of cloud-based healthcare workforce management solutions

The cloud-based deployment of healthcare workforce management solutions has gained significant traction. According to the Cisco Global Cloud Index Forecast, the global cloud Internet Protocol (IP) traffic is projected to grow at a CAGR of 30% during 2015–2020. The cloud-based deployment model provides advantages such as lucrativeness, easy and extreme speed of deployment, and more agile management and operation of workforce solutions. The cloud platform caters to the requirement of geographically dispersed business units by offering one consolidated platform. To leverage the advances of this technology, organizations are moving from on-premises workforce management solutions to workforce management solutions deployed in the cloud.

RESTRAINT: Privacy & Data Security Concerns to restrain the growth of healthcare workforce management systems market

The healthcare workforce management systems help greatly in managing the healthcare workforce efficiently; however, easy access of employee data to HR and managers and self-service provision for employees has led to greater data risk and liability. The wide spread of employee-related data further leads to privacy and security risks which may lead to increase in the incidences of data breaches.

In 2021, the HIPAA Journal documented 712 healthcare data breaches in the US, an surge of 10.9% over the total number of breaches tracked in 2020. Between 2009 and 2021, 4,419 healthcare data breaches of 500 or more records have been stated to the HHS Office for Civil Rights. Those breaches have risen in the loss, theft, exposure, or impermissible disclosure of 314,063,186 healthcare records. Thus, generating a safe communication platform is a major challenge met by IT vendors catering to the healthcare industry. Potential safety concerns related to HCIT systems may lead to a increase in the sense of insecurity among users and, hence, restrain their adoption until protected workforce management solutions are available in the market.

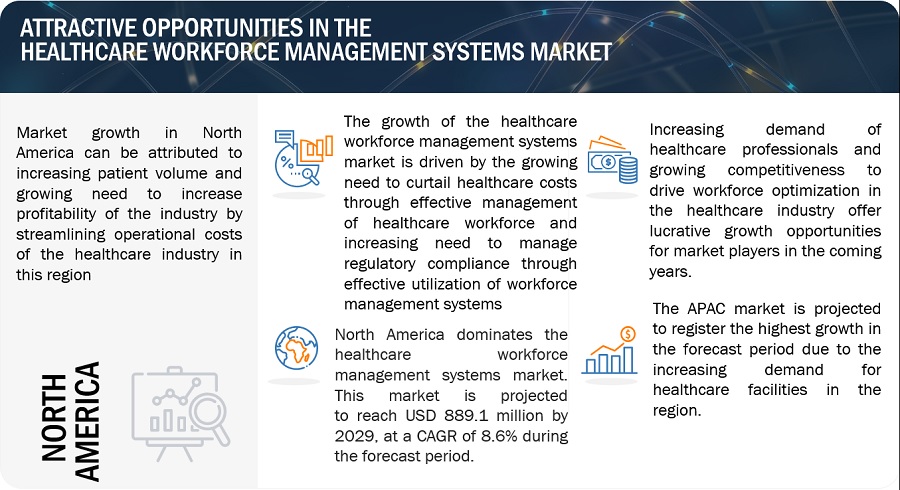

OPPORTUNITY: Growing competitiveness to drive workforce optimization in the healthcare industry

Healthcare workforce management systems provide organizations with various benefits and profitable outcomes. Amidst the resource crunch, in order to compete, hospitals need to attract, manage, and retain the best talent while managing costs and processes effectively to deliver high-quality patient care. Therefore, hospitals need effectively utilize advanced tools and processes to leverage their biggest asset and largest expense—employees.

Thus, with growing competitiveness in the healthcare industry, there will be a greater demand from healthcare providers to effectively manage their workforce, while ensuring cost optimization. This provides a greater opportunity for healthcare workforce management systems vendors to penetrate into the growing healthcare industry across the world. Moreover, creating a greater awareness of the operational, functional, and economic benefits of workforce management systems will further help fuel the demand for workforce management systems from healthcare provides across the world.

Challenge: Integration Concerns Hindering the Market

Integrating workforce management systems with existing healthcare information systems (HIS) presents several challenges. These obstacles can impact the seamless flow of data and limit the effectiveness of workforce management solutions. Many healthcare organizations rely on outdated legacy systems that may not be compatible with modern workforce management solutions. Integrating new systems with these old technologies can be difficult and costly. Integrating new technologies into existing workforce management systems is complex, involving technical, operational, and cultural challenges. It's crucial to align technology solutions with the organization's strategic goals to enhance rather than disrupt existing workflows. This requires thorough planning, evaluating various technology options, and engaging stakeholders across the organization to ensure buy-in and support. Successful integration also hinges on providing adequate training and resources to employees so they can effectively leverage new tools.

By end user, hospitals were the largest market for healthcare workforce management systems industry in 2023.

On the basis of end users, the healthcare workforce management systems market is divided into hospitals, nursing homes, assisted living centers, long-term care facilities, and other end users. In 2023, the hospitals segment accounted for the largest market due to increasing consolidation in the healthcare provider industry and rising adoption of workforce management systems in hospitals across the globe. Workforce management software systems are now recognized as basic elements of hospitals to keep track of employees and provide the best care to patients. In order to enhance the quality of care and optimize the workflow, hospitals have to schedule skilled resources at the right place at the right time, which, if not managed properly, could lead to complexities. Workforce management systems are used to reduce such complexities involved in the process of managing shift differentials of numerous healthcare professionals and to facilitate the analysis of employee data for healthcare administrators at any given point in time.

By organization size, large enterprises are expected to dominate the healthcare workforce management systems industry in 2024.

Based on organization size, the healthcare workforce management systems market is segmented into large enterprises, medium enterprises & small enterprises. Large enterprises accounted for the largest share of the healthcare workforce management systems market. Growing need to analyze workforce management data for achieving organizational goals is expected to drive healthcare workforce management solutions and services adoption among large enterprises.

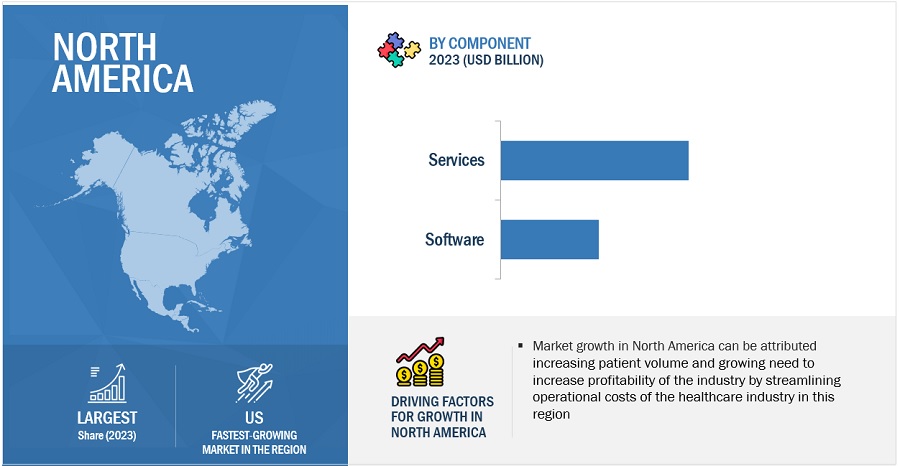

By region, North America was the largest regional market for healthcare workforce management systems industry in 2023.

Based on region, the healthcare workforce management systems market is bifurcated into North America, Europe, the Asia Pacific, Latin America, Middle East & Africa. North America was the largest regional segment of the overall market with a share followed by Europe in 2023. The healthcare workforce management systems have many opportunities within the US considering the availability of many large hospitals and health systems, changing regulations, increasing demand for health professional workforce and driving the market growth in North America.

To know about the assumptions considered for the study, download the pdf brochure

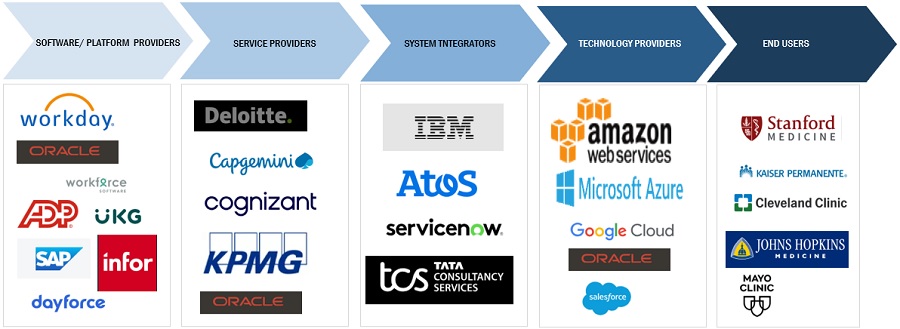

Prominent players offering healthcare workforce management systems industry include Infor (US), UKG Inc. (US), Oracle Corporation (US), Automatic Data Processing, Inc. (US), SAP SE (Germany), Workday, Inc. (US), ATOSS Software AG (Germany), WorkForce Software, LLC. (US), Paycor HCM,Inc. (US), Dayforce, Inc. (US), Zoho Corporation Pvt. Ltd. (US), Connecteam (US), Cornerstone (US), Strata Decision Technology (US), symplrv (US), Rippling People Center Inc. (US), Bamboo HR LLC. (US), Hireology (US), Deputy (Australia), Paylocity Holding Corporation (US), Shiftboard, Inc. (US), Humanforce Holdings Pty Ltd (Australia), T3 Workforce (Australia), Legion Technologies, Inc. (US), Quinyx AB (Sweden)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Component, Deployment, Organization Size, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East Africa. |

|

Companies covered |

Infor (US), UKG Inc. (US), Oracle Corporation (US), Automatic Data Processing, Inc. (US), SAP SE (Germany), Workday, Inc. (US), ATOSS Software AG (Germany), WorkForce Software, LLC. (US), Paycor HCM, Inc. (US), Dayforce, Inc. (US), Zoho Corporation Pvt. Ltd. (US), Connecteam (US), Cornerstone (US), Strata Decision Technology (US), symplr (US), Rippling People Center Inc. (US), Bamboo HR LLC. (US), Hireology (US), Deputy (Australia), Paylocity Holding Corporation (US), Shiftboard, Inc. (US), Humanforce Holdings Pty Ltd (Australia), T3 Workforce (Australia), Legion Technologies, Inc. (US), Quinyx AB (Sweden) |

The study categorizes the healthcare workforce management systems market into the following segments and subsegments:

Healthcare Workforce Management Systems Market, By Component

- Software

- Standalone Software

- Time & Attendance Management Software

- Scheduling Software

- Talent Management Software

- HR & Payroll Management

- Workforce Analytics

- Others Standalone Software

- Integrated Software

- Services

- Support & Maintenance Services

- Optimization/Consulting Services

- Implementation Services

- Education/ Training Services

Healthcare Workforce Management Systems Market, By Deployment

- On-premises Model

- Cloud-based Model

- SaaS- Based/Web-based Model

Healthcare Workforce Management Systems Market, By Organization Size

- Large

- Medium

- Small

Healthcare Workforce Management Systems Market, By End User

- Hospitals

- Nursing Homes

- Assisted Living Centers

- Long-term Care Facilities

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- GCC countries

- Rest of Middle East & Africa

Recent Developments of Healthcare Workforce Management Systems Industry:

- In May 2024 Cornerstone (US) launched Cornerstone Galaxy, an AI-powered workforce agility platform, aimed at solving the workforce readiness gap. The workforce readiness gap is created by the pace of change from innovation, market changes, and other factors becoming out of sync with a workforce’s ability to adapt. The Workforce Readiness Gap Report launched in partnership with Lighthouse Research, revealed this gap is widening with 63% of enterprise leaders responding that they don’t believe their workforce is adaptable to change and 60% who believe that AI has increased the pace of workplace change.

- In February 2024, Workday, Inc. (US) partnered with Insperity, Inc. (US) (NYSE: NSP) to jointly develop, brand, market, and sell a preeminent full-service HR solution for small and midsize businesses. Through this partnership customers will have the benefit of Insperity’s Workforce Optimization premium service experience, which includes dedicated HR specialists, payroll and benefits, risk management, and compliance support, along with Workday Human Capital Management (HCM).

- In February 2023, Infor (US) revealed Infor Clinical Science, part of the Infor Workforce Management suite. This application usages an evidence-based methodology to determine the workload of each patient, accounting for both direct and indirect workloads, to provide leaders with a whole picture of labor requirements for each shift, unit, or department, all based on documents already arising in the electronic medical record (EMR).

- In January 2023, Strata Decision Technology launched a (US) Real-Time Workforce Management (RTWM) solution, designed to address the financial and operational goals of nursing leaders. Building upon the robust StrataJazz platform, the RTWM solution equips nursing leadership with precise, actionable data aimed at enhancing communication between leaders and staff.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global healthcare workforce management systems market?

The global healthcare workforce management systems market boasts a total revenue value of $2.8 billion by 2029.

What is the estimated growth rate (CAGR) of the global healthcare workforce management systems market?

The global healthcare workforce management systems market has an estimated compound annual growth rate (CAGR) of 10.1% and a revenue size in the region of $1.7 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the current size of the healthcare workforce management market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the healthcare workforce management market. The researchers used secondary sources, which means they looked at existing information instead of collecting new data themselves. These secondary sources included reports and publications from organizations like the World Health Organization (WHO), Healthcare Information and Management Systems Society (HIMSS), American Health Information Management Association (AHIMA), Centers for Medicare and Medicaid Services (CMS), US Department of Health and Human Services (HHS), Organisation for Economic Co-operation and Development (OECD), National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. This method allowed the researchers to gather information on the market size, segmentation (by component, deployment, organization size, and end-user), regional analysis, future trends, and technological advancements in the healthcare workforce management market.

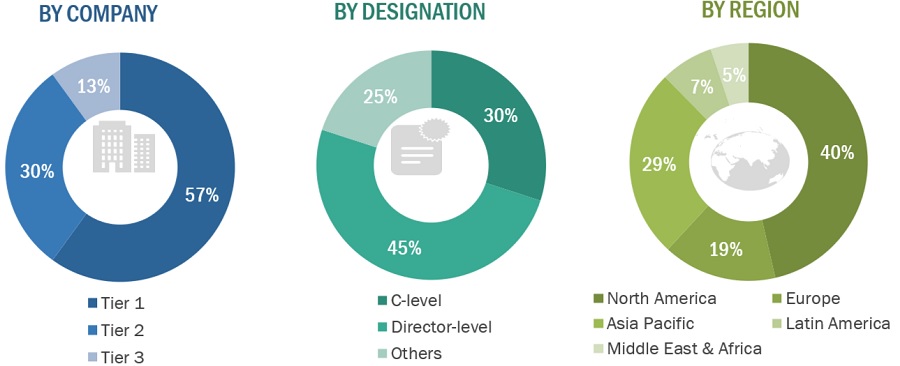

Primary Research

In-depth interviews were conducted with various primary respondents; researchers conducted in-depth interviews with a variety of people. The primary sources from the supply side include Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), marketing and sales directors, business development managers of healthcare workforce management companies. On the other hand, primary sources from the demand side include industry experts such as directors of hospitals, nursing homes, physicians, and related key opinion leaders. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product and service managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

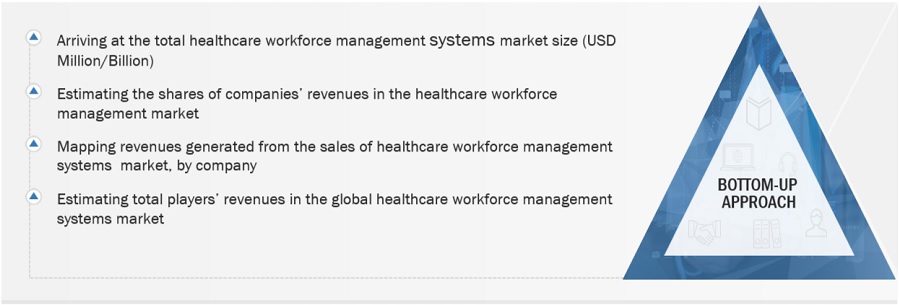

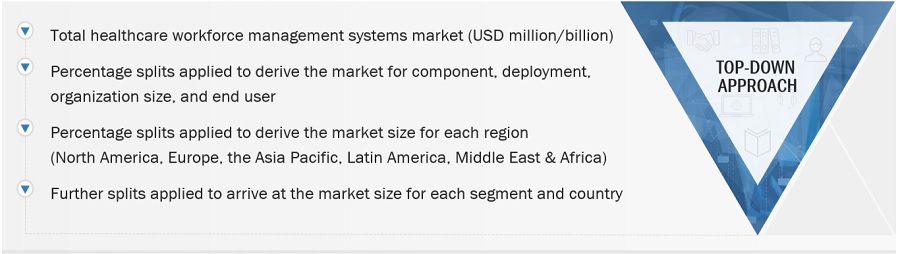

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare workforce management market as well as to estimate the market size of various other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues generated from the healthcare workforce management business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Healthcare Workforce Management Systems Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare Workforce Management Systems Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Healthcare workforce management systems encompass all the solutions needed to manage and maintain the productive workforce in a healthcare organization. Workforce management includes HR administration, career and succession planning, adherence to work schedules, talent acquisition, workforce tracking, payroll and benefits, and leave management.

Key stakeholders:

- Healthcare Workforce Management Vendors

- Healthcare IT solution providers

- Healthcare IT service providers

- Healthcare providers

- Assisted Living Centers/Nursing Homes

- Ambulatory Care Centers

- Integration Service Providers

- Maintenance And Support Service Providers

- Regulatory Bodies

- Market research and consulting firms

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the global healthcare workforce management market based on the component, deployment, organization size, end user and region.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall healthcare workforce management market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, collaboration, and partnerships in the healthcare workforce management market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Workforce Management System Market